The swift collapse of Afghanistan puppet government when US troops withdrew from the war with the Taliban and left the country after 20 years has been likened to the fall of Saigon at the end of the 30-year ‘American’ war against the Vietnamese people. The scenes of Afghans trying to get onto US planes at the airport to escape seem startlingly familiar to those of us who can remember the last days of Saigon.

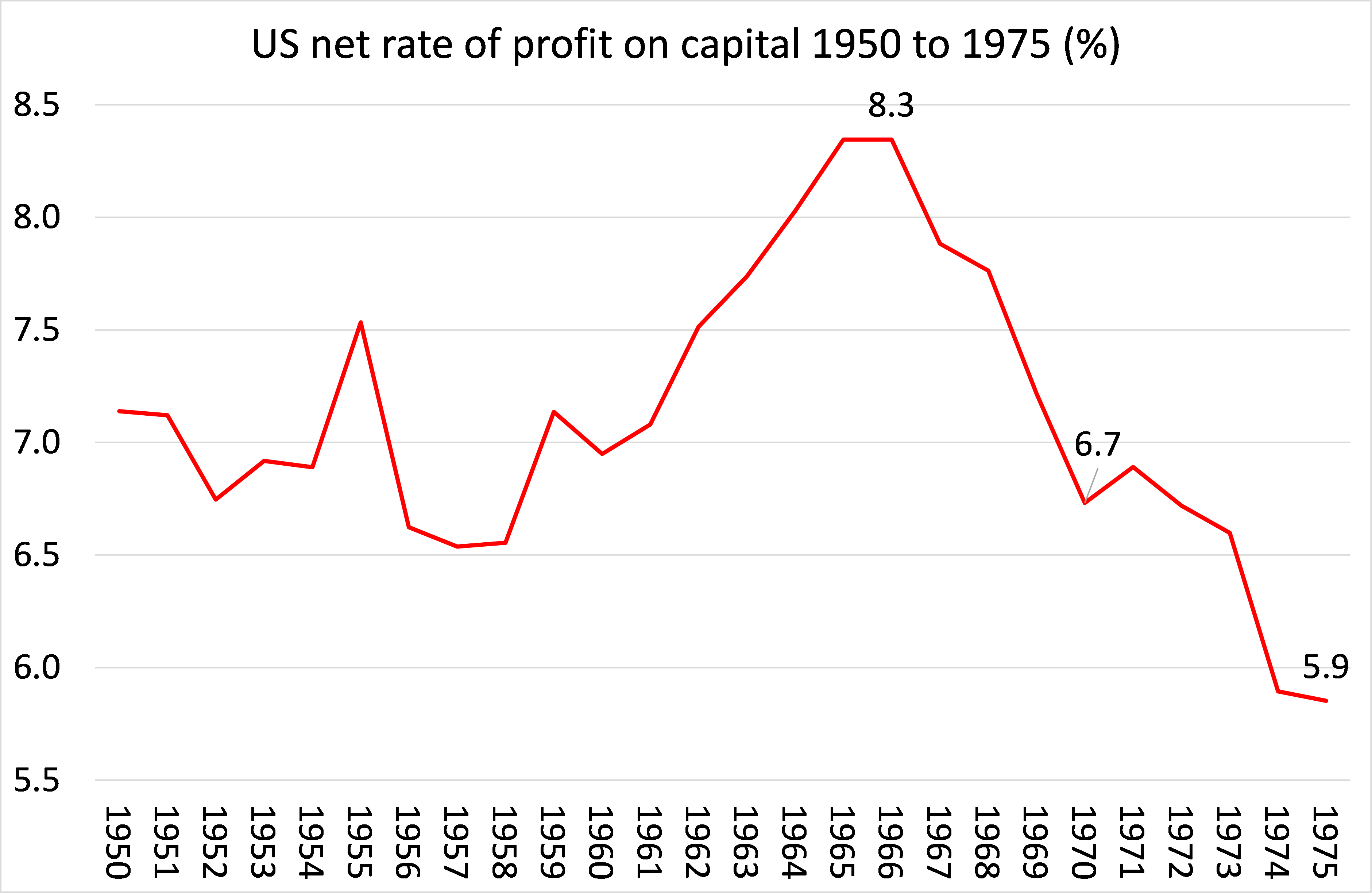

But is this a superficial similarity? After all, America’s occupation of Vietnam was way more costly as a share of US national output and in terms of the lives of American soldiers than the attempt at ‘regime’ change in Afghanistan. The Vietnam disaster led to the US government running deficits for the first time since WW2. But even more important, it meant a diversion of investment into arms rather than productive sectors at a time when the profitability of capital had already begun to fall, the Golden Age of investment and profitability having peaked in the mid-1960s.

Indeed, by the end of the 1960s, it was clear that the US could never win in Vietnam, just as it was clear at least a decade ago (if not from the very beginning) that it could not win in Afghanistan. But the ruling elite continued under Nixon and Kissinger to prosecute the war for several more years, spreading it into neighbouring countries like Laos and Cambodia.

But by the official end of the war in Vietnam, the economic consequences of this 30-year ‘intervention’ exposed an important turning point – the end of Pax Americana and the outright hegemonic position of American imperialism in the world economy. From then on, we can talk about the relative decline (relative to other imperialist powers) of the US, with the rise of the European countries, Japan, East Asia and more recently China. Despite the collapse of the Soviet Union in the late 1980s and early 1990s, the end of the ‘cold war’ did not reverse or even curb that relative decline. The US no longer can rule the world on its own and, even with the help of a ‘coalition of the willing’, it cannot dictate a ‘world order’.

Economically, it all started before the fall of Saigon. As the profitability of US capital started to fall from the mid-1960s, US industry began to lose its competitive advantage in manufacturing and even in various services to rising Franco-German capital and Japan. This eventually meant that the economic world order after WW2, which had established the economic hegemony of the US economy and its currency, the dollar, started to crumble.

Indeed, it is 50 years to the month when officials of President Nixon’s administration met secretly at Camp David to decide on the fate of the international monetary system. For the previous 25 years, the US dollar had been fixed to the price of gold ($35/oz) by international agreement. Anybody holding a dollar could convert into a fixed amount of gold from US reserves. But in August 1971, President Nixon took to national television to announce he had asked Treasury Secretary John Connally to “suspend temporarily the convertibility of the dollar into gold or other reserve assets.”

It was the end of the so-called Bretton Woods agreement, so painfully negotiated by the Allied powers, namely the US and the UK, over the heads of all the other countries in the world. Conceived, along with the IMF, the World Bank and the UN, the agreement established a framework that committed all to fixed exchange rates for their currencies and fixed in terms of the US dollar. The US in turn would fix the value of the dollar in terms of gold. No country could change their rates without IMF agreement.

But with Nixon’s announcement, the fixed exchange rate regime was ended; it was the US that had abandoned it and, with it, the whole post-war Keynesian-style international currency regime. It was no accident that the ending of the Bretton Woods system also coincided with the ending of Keynesian macro management of the US and other economies through the manipulation of government spending and taxation. The post-war economic boom based on high profitability, relatively full employment and productive investment was over. Now there was a decline in the profitability of capital and investment growth, which eventually culminated in the first post-war international slump of 1974-5; and alongside this was the relative decline of American industry and exports compared to competitors. The US was no longer exporting more manufacturing goods to Europe, Latin America or Asia than it was importing commodities like oil from the Middle East and manufacturing from Germany and Japan. It was starting to run trade deficits. The dollar was thus seriously overvalued. If US capital, particularly manufacturing was to compete, the dollar fix to gold must be ended and the currency allowed to depreciate.

As early as 1959, Belgian-American economist Robert Triffin had predicted that the US could not go on running trade deficits with other countries and export capital to invest abroad and maintain a strong dollar: “if the United States continued to run deficits, its foreign liabilities would come to exceed by far its ability to convert dollars into gold on demand and would bring about a “gold and dollar crisis.”

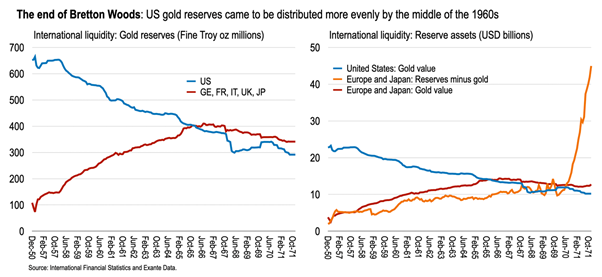

And that is what happened. Under the dollar-gold standard, imbalances in trade and capital flows had to be settled by transfers of gold bullion. Up until 1953, as war reconstruction took place, the US had actually gained gold of 12 million troy ounces, while Europe and Japan had lost 35 million troy oz (in order to finance their recovery). But after that, the US started to leak gold to Europe and Japan. By end-1965, the latter surpassed the former for the first time in the post-war period in terms of gold volumes held in reserve. As a result, Europe and Japan began to pile up huge dollar reserves that they could use to buy US assets. The global economy has begun to reverse against the US.

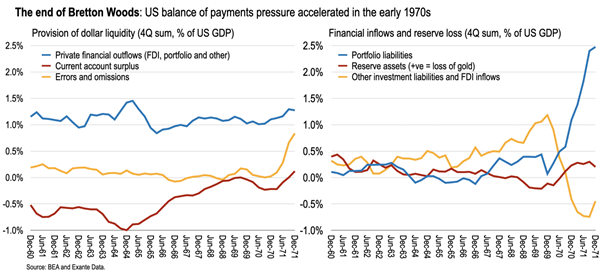

The dollar reserves in Europe and Japan were now so large that if those countries bought gold with their dollars under the gold standard, they could exhaust US gold stocks in an instant. Private financial outflows (outbound investment) from the US averaged roughly 1.2% of GDP throughout the 1960s—long term investment overseas through FDI or portfolio outflows. This served to finance net exports of US investment goods and a current account surplus, shown as negative here as an offsetting withdrawal of dollars. Netting these, about 0.4% of US GDP in surplus outward investment was made available every year during the 1960s from the US. This surplus was available for current account deficit countries in Europe and Japan to liquidate US gold, replenishing their diminished reserve positive, or accumulate other financial claims on the US—as shown on the right side.

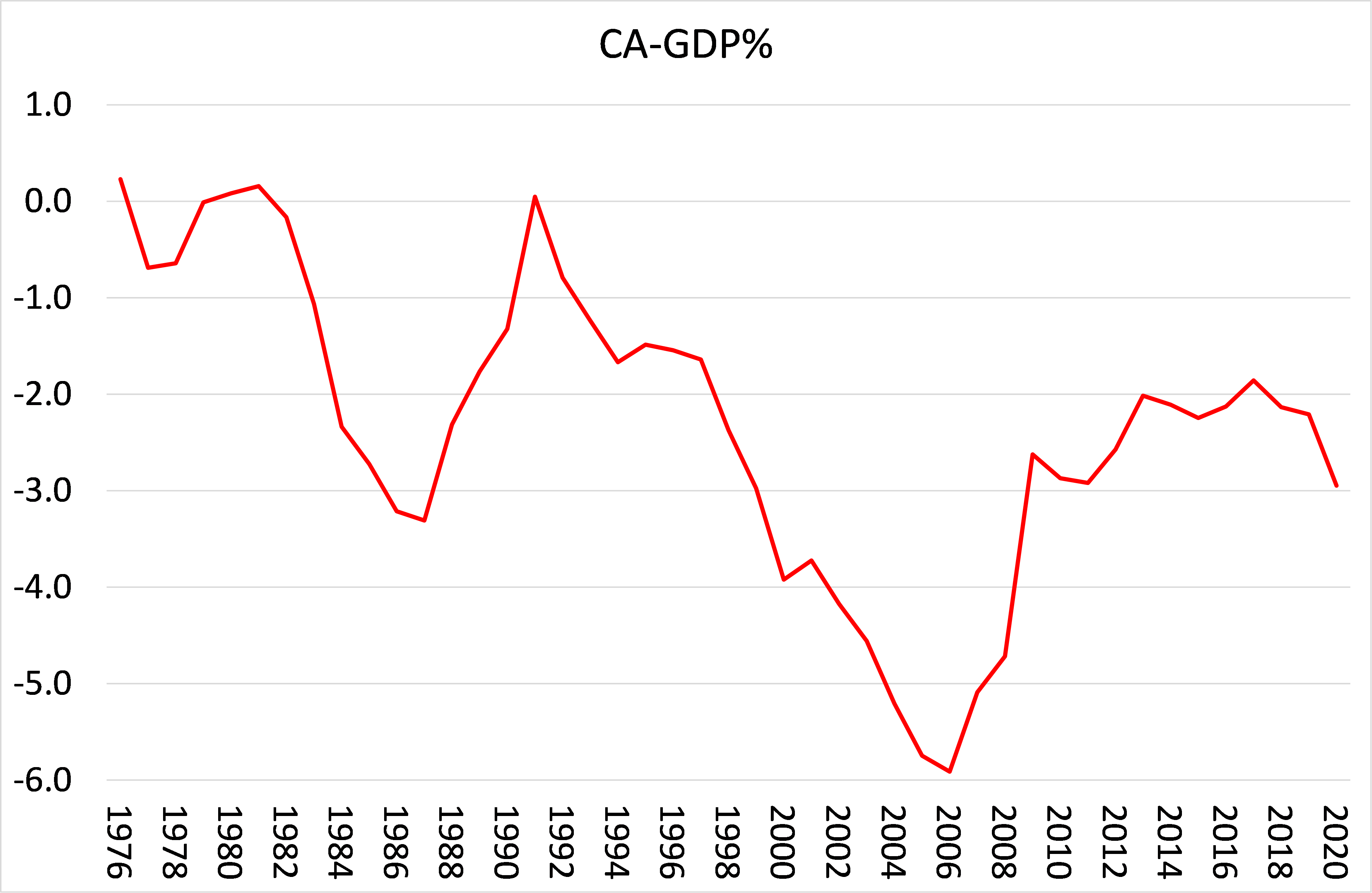

But throughout the 1960s, the US current account surplus was gradually eroded until, in the early 1970s, the current account was registering a deficit. The US began to leak dollars globally not only through outward investment but also through an excess of spending and imports as domestic manufacturers lost ground.

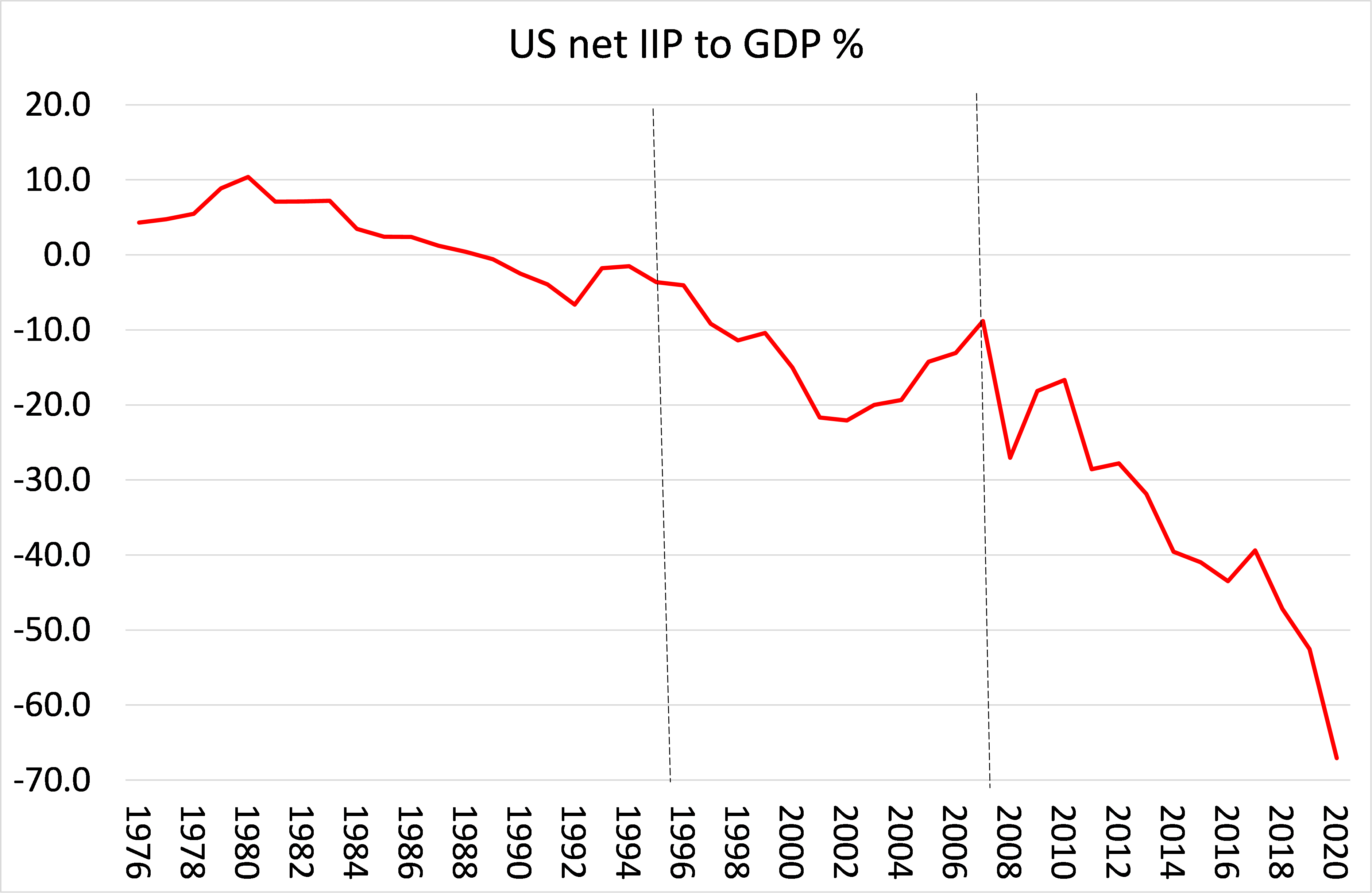

The US became reliant for the first time since the 1890s on external finance for the purposes of spending at home and abroad. So US external accounts were driven less by real goods and services and more by global demand for US financial assets and the liquidity they provided. By the 1980s, the US was building up net external liabilities, rising to 70% of GDP by 2020.

If a country’s current account is permanently in deficit and it depends increasingly on foreign funds, its currency is vulnerable to sharp depreciation. This is the experience of just about every country in the world, from Argentina to Turkey to Zambia, and even the UK.

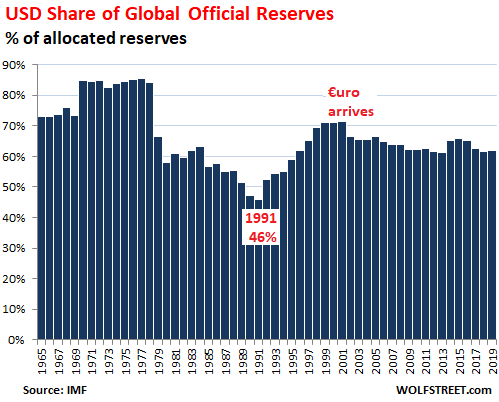

However, it is not the same for the US because what is left from the Bretton Woods regime is that the US is still the main reserve currency internationally. Roughly 90% of global foreign exchange transactions involve a dollar leg; approximately 40% of global trade outside the US is invoiced and settled in dollars; and almost 60% of U.S. dollar banknotes circulate internationally as a global store of value and medium of exchange. Over 60% of global foreign exchange reserves held by foreign central banks and monetary authorities remain denominated in dollars. These ratios have not changed.

Export surplus countries like the European Union, Japan, China, Russia and Middle East oil states pile up surpluses in dollars (mainly) and they buy or hold assets abroad in dollars. And only the US treasury can ‘print’ dollars, gaining a profit from what is called ‘seignorage’ as a result. So, despite the relative economic decline of US imperialism, the US dollar remains supreme.

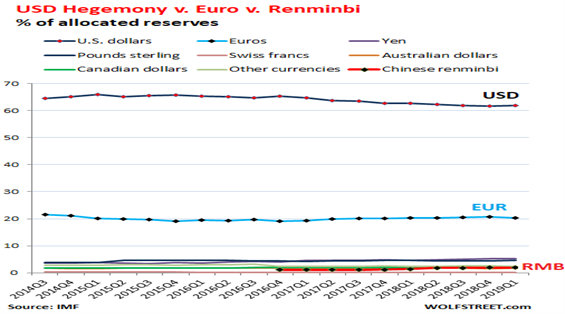

This reserve currency role encouraged US Treasury Secretary John Connally, when he announced the end of the dollar-gold standard in 1971 to tell EU finance ministers “the dollar is our currency, but it is your problem.” Indeed, one of the reasons for the European Union, led by Franco-German capital, to decide to establish a single currency union in the 1990s was to try and break the dollar hegemony of international trade and finance. That aim has had only limited success, with the euro’s share of international reserves stable at about 20% (and nearly all of this due to intra-EU transactions).

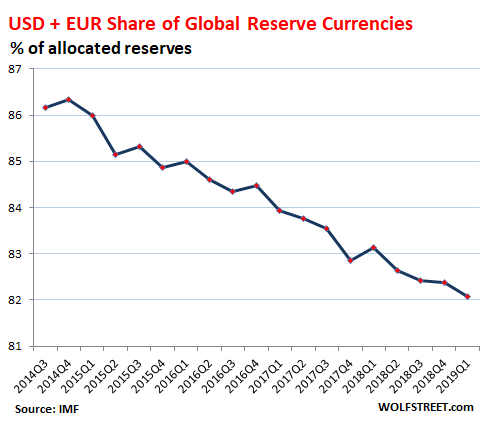

International competitors such as Russia and China routinely call for a new international financial order and work aggressively to displace the dollar as the apex of the current regime. The addition of the renminbi in 2016 to the basket of currencies that composes the IMF’s special drawing rights represented an important global acknowledgment of the increasing international use of the Chinese currency. And there is talk of rival countries launching digital currencies to compete with the dollar. But although the dollar-euro share of reserves has declined in favour of the yen and renminbi from 86% in 2014 to 82% now, alternative currencies still have a long way to go to displace the dollar.

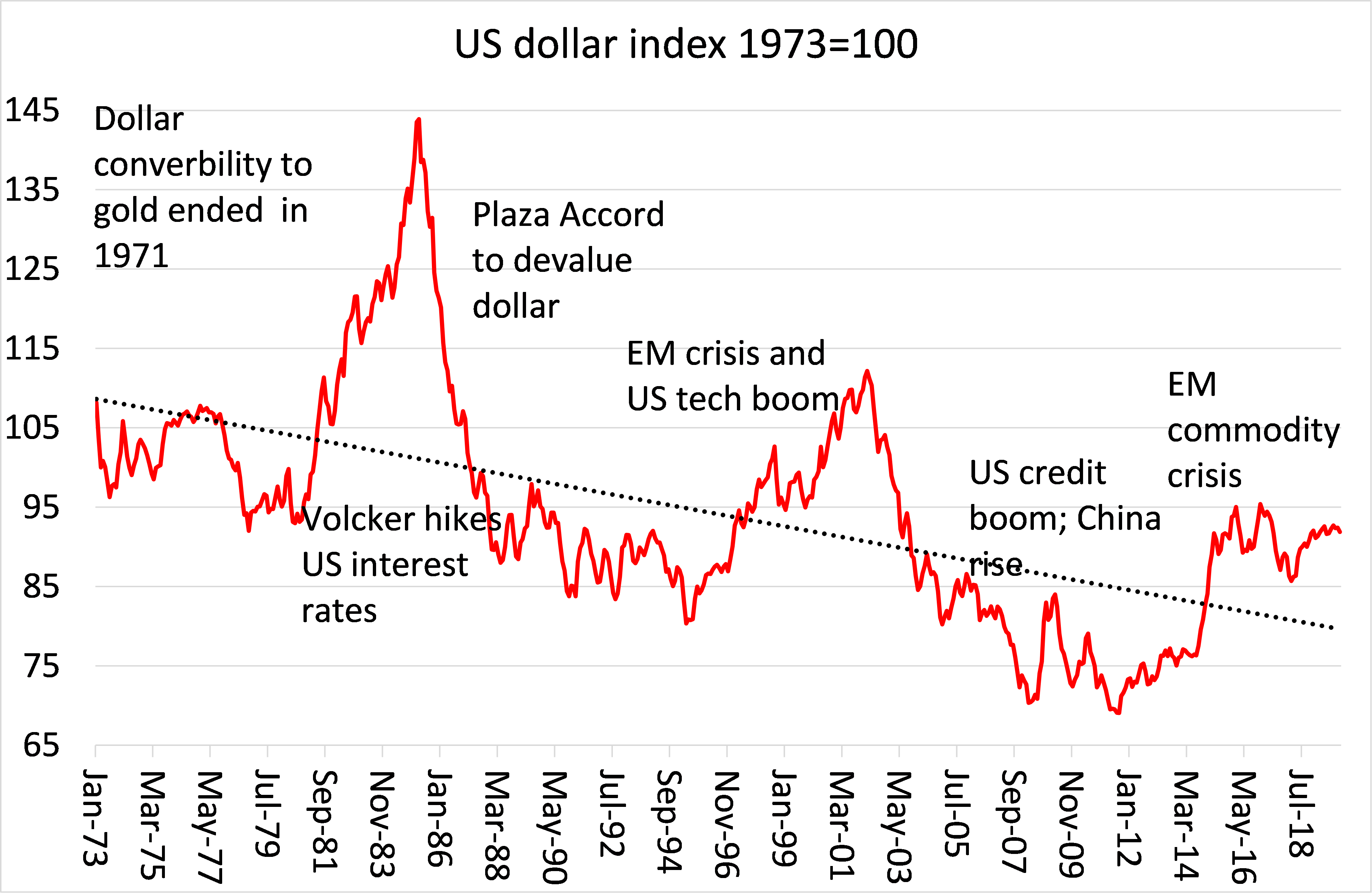

Having said that, the underlying relative decline in US manufacturing and even services competitiveness with first Europe, then Japan and East Asia and now China, has gradually worn away the strength of the US dollar against other currencies as the supply of dollars outstrips demand internationally. Since Nixon’s momentous announcement, the US dollar has declined in value by 20% – maybe a good barometer of the relative decline of the US economy (but an underestimate because of the reserve currency factor).

The dollar’s decline has not been in a straight line. In global slumps, the dollar strengthens. That’s because as the international reserve currency, in a slump, investors look to hold cash rather than invest productively or speculate in financial assets and the safe-haven then is the dollar.

That’s especially the case if US interest rates on dollar cash are high compared to other currencies. To break the inflationary spiral at the end of the 1970s, the then Federal Reserve Chair Paul Volcker deliberately hiked interest rates (adding to the depth of the economic slump of 1980-2). In the slump, investors rushed into high-yielding dollars. Bankers loved it, but not US manufacturers and exporters, as well as countries with large US dollar debts. The slump was bad enough, but Volcker’s action was squeezing the world economy to death.

Finally, in 1985, at a meeting at the Plaza Hotel, New York of central bankers and finance ministers in the then big 5 economies, it was agreed to sell the dollar and buy other currencies to depreciate the dollar. The Plaza accord was another milestone in the relative decline of US imperialism, as it could no longer impose its domestic monetary policy on other countries and eventually had to relent and allow the dollar to fall. Nevertheless, the dollar continues to dominate and remains the currency to hold in a slump, as we saw in dot.com bust and slump of 2001 and in the emerging market commodity slump and euro debt crisis of 2011-14.

The relative decline of the dollar will continue. The Afghanistan debacle is not a tipping point – the dollar actually strengthened on the news of Kabul’s collapse as investors rushed into ‘safe-haven’ dollars. But the monetary explosion and the fiscal stimulus being applied by the US authorities to revive the US economy after the pandemic slump is not going to do the trick. After the ‘sugar rush’ of Bidenomics, the profitability of US capital will resume its decline and investment and production will be weak. And if US inflation does not subside as well, then the dollar will come under more pressure. To distort a quote by Leon Trotsky, ‘the dollar may not be interested in the world economy, but the world is certainly interested in the dollar.’

Courtesy Michael Roberts Blog

Michael Roberts

Michael Roberts worked in the City of London as an economist for over 40 years. He has closely observed the machinations of the global capitalism from within the dragon’s den. Since retiring, he has written several books. The Great Recession – a Marxist view (2009); The Long Depression (2016); Marx 200: a review of Marx’s economics (2018): and jointly with Guglielmo Carchedi as editors of World in Crisis (2018). He has published numerous papers in various academic economic journals and articles in leftist publications.