The ongoing crisis for Chinese property developer Evergrande has made the giant company the focal point of global concern. Creditors, investors, contractors, customers, and employees of Evergrande within and outside China have watched anxiously to see whether the Chinese government would decide that Evergrande was too big to fail. If Evergrande were to collapse, the repercussions for both the financial system and construction supply chains are impossible to predict. Reportedly, the central government in Beijing has issued a warning to local governments to brace for the possible social and political fallout.

Even if Evergrande were salvaged through government intervention, the Chinese state would continue to face new dilemmas. Evergrande is just one of many troubled property development firms that face potential default. As housing prices in China fall, the crisis has already spread to other property developers, such as Kaisa. The US Federal Reserve explicitly warned that China’s housing crisis could spill over to the US and global economy.

The crisis of Evergrande and China’s large property sector is a manifestation of the crisis of China’s growth model. The limits of that model can be seen in ghost towns across the country; China’s empty apartments are estimated to be able to house the entire population of France, Germany, Italy, the UK, or Canada. How could such development sustain high-speed growth for so long, and why has it failed now? To understand the ongoing crisis, we need to understand how property—and fixed investment more broadly—is connected to other moving parts of the Chinese and global economies.

The end of the China Boom

From the mid-1990s until 2008, China’s export sector emerged as a mighty engine of dynamism and profitability. Fueled by global demand and dominated by private and foreign enterprises, the export sector piled up mammoth foreign exchange reserves, which became the monetary foundation for a generous expansion of credit by the CCP-controlled financial system. The growth of foreign exchange reserves allowed Chinese state banks to expand local currency liquidity without the risk of devaluation and capital flight that had plagued expansionary experiments in other developing countries. Most of the new loans flowed to politically well-connected enterprises, which tended to invest in fixed assets like infrastructure, real estate, steel mills, and coal plants.

As Keynes once said, two railways covering the same route are not twice as good as one. Much of China’s debt-financed fixed investment has been redundant and profitless. Since the late 1990s, leaders within the CCP have sounded the alarm about indebtedness and overcapacity. One of their proposed solutions was financial liberalization: If liquidity were allowed to circulate in search of high interest rates, inefficient enterprises would find themselves cut off from the cheap credit that kept them afloat. But other factions of the party-state elite saw the profitless and overextended sectors as potential cash cows and quasi-fiefdoms. Reforms never gained traction.

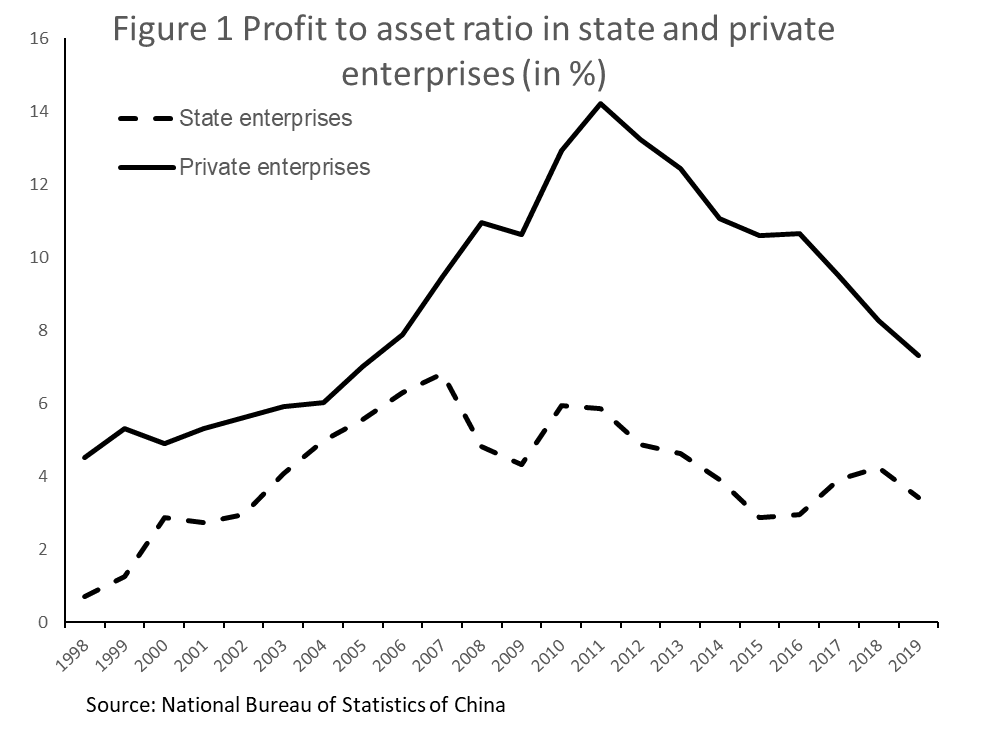

The first blow to China’s long export-led boom came with the global financial crisis of 2008–2009. In response to the collapse of global demand, the Chinese government unleashed an aggressive—and successful—monetary stimulus. Driven by the greatest wave yet of debt-financed investment in fixed assets, the economy rebounded strongly from the crisis. But with the export engine stalled, this redoubled expansion of state-bank credit for investment was no longer matched by the expansion of foreign exchange reserves. The result was an enormous debt bubble. Between 2008 and late 2017, outstanding debt in China soared from 148 percent of GDP to over 250 percent. The 2020 pandemic brought a new surge of loans, which pushed the debt-GDP ratio to more than 330 percent, according to one estimate. Following well-worn grooves, most of this debt went to finance new apartments, coal plants, steel mills, and infrastructure projects. With few to consume their eventual output, the new investments merely generated further unprofitable excess capacity. After the 2009–10 rebound, the profitability of enterprises continued to fall across the board in both private and state sectors, as shown in Figure 1 below.

Falling profits add an urgent twist to the problem of indebted overcapacity. Profits provide firms with the cash flow to service their debts and pay back their loans. In China, the declining returns created a debt time-bomb: What would happen when the defaults started? CCP economic managers had run out of room for debt-financed investment stimulus. Meanwhile, the growth of the export sector remained below pre-2008 levels. In search of a new engine of expansion, Beijing called for a shift away from fixed investment and toward private domestic consumption. The volume of private consumption did climb rapidly after China’s accession to the WTO in 2001, but it never grew fast enough to catch up with the expansion in investment (see Figure 2 below). The disappointing growth of the consumption share was the result of escalating inequality. Throughout the long export boom, average household income grew much more slowly than the economy at large. This meant that most of the new income generated by the economy went to the government and other enterprises, instead of being paid out to employees as wages and salaries. Instead of increasing consumption, the surplus was ploughed back into more investment and further excess capacity.

Proposals for rebalancing had been heard even before 2008. A rising share of consumption in the economy would mean new sources of final demand that could soak up excess capacity and provide firms with increased sales. Yet reaching the income distribution necessary for such private-consumption-boosting rebalancing is easier said than done, thanks to the monopoly of power by the party-state elite.

These stubborn problems underpinned the next stage in China’s trajectory. In 2015–16, a stock market meltdown and capital flight forced a sharp devaluation of the Chinese currency. By 2016, the economy had stabilized, but only after renewed tightening of capital controls. The banking system also injected rounds of new credit into the economy to keep it moving. One sign of widespread financial fragility was that many of the loans were needed to roll over existing debt, rather than to finance new production or consumption.

This impasse of the Chinese economy is illustrated by the stagnation of manufacturing, as revealed by the manufacturing Purchasing Manager Index (PMI), a lead indicator of manufacturing activities. On the PMI, a value above 50 indicates expansion and a value below 50 indicates contraction. In Figure 3 (below), the right-hand axis shows that PMI has hovered around 50 (the stagnation level) for a decade. The left-hand axis shows the volume of new loans. Comparing the new loan data with the manufacturing index, we can see the diminishing effectiveness of loan stimulus. Ever since the 2009–10 rebound, it has taken ever-larger loan injections just to keep the economy turning over. As recurrent and ever-larger credit surges brought further buildup of indebtedness in the economy without adding new dynamism, enterprises became loan-addicted zombies.

Two capitals

Since the late 1990s, various solutions have been offered to the problem of indebted overcapacity, including liberalization of financial markets and raising private consumption. But over the last decade of stagnation, a different kind of rebalancing has come to define the Chinese political economy: “the state advances, the private sector retreats” (guojin mintui). Though the idea is sometimes analyzed in terms of shifting party ideology or individual leadership styles, the state-led squeeze of the private sector and foreign enterprises largely reflects broader economic conditions. In a low growth environment, state-connected firms must pursue growth at the expense of other sectors. Their alliances with party leaders gives them the capacity to follow through on this strategy.

The state sector’s ability to maneuver rests on China’s unique form of property ownership—specifically, the fact that the state remains the universal landlord. During the 1950s, the CCP abolished private property and established the party-state, a self-assigned representative of the people, as the single owner of all property. Despite sweeping economic reforms since 1978, the party-state has never changed the state ownership of land or its status as the most significant form of property. The state facilitated the rise of a private economy by granting time-limited use rights of landed property to individual entrepreneurs. Such use rights have expiration dates, and the state retains the power to set the terms of renewal or to cancel the use right at any time. This is how rural market reform took off in the late 1970s, when the state instituted the user-responsibility system (leasing land use rights to peasant households while the state continued to own the land). A similar marketization of land use rights under state ownership began in the cities in the mid-1980s, beginning with Shanghai’s land-use reform. These reforms, which culminated in the 1990s, created the conditions for the rise of Evergrande-style property development without subverting state ownership of land property.

In addition to land, Beijing never let go of state-owned companies’ domination in key sectors. The state-owned enterprises’ reform over the 1990s was not exactly a “privatization.” Many state-owned giants were restructured on the model of profit-oriented Western transnational corporations and shed nearly all of their social functions, such as providing housing and healthcare to their employees. But many of the largest ones remained under the control of local or central governments through direct state ownership or state shareholding of public companies. Chinese companies in the Global Fortune 500 list grew from 10 in 2000 to 124 in 2020. Of the 124, 91 are state-owned enterprises. State-owned industrial assets total twice as much as private industrial assets in the whole economy, with state-owned assets occupying a predominant role in sectors such as finance, energy, automobile, telecommunication, and mining.

Thus, throughout the long export boom, China’s political economy was driven by profit-driven market exchanges grounded in the temporary ownership of property by entrepreneurs and individuals. Over time, many investors came to see the state ownership of property as a formality, and expected that renewal of use rights would be routine and ritualistic. As long as the growing Chinese economy offered a high return on investment, enterprising individuals were happy to keep their wealth and property in China and repress any concerns about the ultimate security of their property. But as growth rates and profits fell, investors renewed their attention to the transient nature of their property, given the continuing relevance of the Chinese Constitution’s Article 6 (“the State upholds the basic economic system in which public ownership is dominant”) and Article 7 (“the State-owned economy … is the leading force in the national economy. The State ensures the consolidation and growth of the State-owned economy”).

The squeeze on private and foreign business became increasingly clear after 2008. As the world recession froze economic growth, a new anti-monopoly law promulgated by Hu Jintao was applied much more energetically against private and foreign enterprises than state-owned ones. To be sure, many individual party bosses of state enterprises have been purged in intra-elite conflict in the name of “anti-corruption.” But the privileges of state enterprises were rarely touched by the anti-monopoly law, even though the state sector is home to key monopolies such as telecommunications and energy. Conversely, confiscation of individual wealth in the name of the anti-corruption campaign became normal. The combination of increasing insecurity of the wealthy and entrepreneurial, the falling profitability in a slowing economy, and the expectation of long-run devaluation of the RMB triggered a wave of capital flight that culminated in the financial tumult in the summer of 2015, discussed above. Though the renewed strengthening of capital control has contained such flight, enterprises and wealthy individuals in China have become ever more eager to shift their wealth out of China into jurisdictions with greater legal protection of private property.

When Xi Jinping came to power in 2012, many observers expected him to pursue economic liberalization. During the early days of Xi’s reign, state media promoted this message with discussions of financial deregulation and “supply-side structural reform,” which, as the New York Times put it in 2016, “sounds less like Marx and Mao than Reagan and Thatcher.” But hopes that Xi would be a Deng Xiaoping–style pro-market strongman were soon punctured. The strength of vested interest groups within the party-state left Xi little choice but to support the continuous expansion of state-owned or state-connected companies at the expense of private and foreign ones.

While the statist turn predated Xi, he has overseen a significant acceleration of the process. Just this year, Xi introduced the program of “common prosperity.” The slogan went hand in hand with a crackdown on private enterprises. Repressive measures have included tblocking, last-minute, an overseas IPO by Ant Group (Alibaba’s fintech arm); imposing a hefty anti-monopoly fine on Alibaba; placing heavy restrictions on technology firms’ ability to collect data and provide services; banning for-profit school tutoring firms; and allowing state firms to take over key assets of private tech firms—to name just a few.

Evergrande and the Future of Chinese Capitalism

In 2016, a state-owned publishing house in Beijing put out a simplified Chinese version of my book The China Boom. In this edition, all my references to “capitalism in China” were translated as “market socialism with Chinese characteristics.” This is the strict official self-description of the Chinese party-state, whose official publications never use “capitalism” or “Chinese capitalism” to characterize the nation’s economic system. Some Western leftists, such as David Harvey, have begun to speculate that Xi is steering China back onto the socialist road abandoned after Mao’s death. The idea of a Maoist, anti-capitalist turn can also be found in outlets such as The Wall Street Journal and The Washington Post.

Though increasingly widespread, the idea that China is moving away from capitalism is inaccurate. After four decades of reform, the Chinese economy has still not evolved into the textbook neoliberal capitalist model predicted (and advocated) by the literature on “market transitions.” But the Chinese system—characterized by the full commodification of the means of livelihoods, prevalence of the profit imperative in all economic activities, state ownership of all land property plus weak protection of other forms of private property, and dominance of state enterprises—is probably best understood as state capitalist or party-state capitalist. Putin’s Russia provides Xi with an example of how an autocratic regime can weather economic downturns once all oligarchs with independent power bases have been rounded up, contained, or exterminated. What Beijing wants is to restrain the accumulation of private capital to make more room for the accumulation of state capital. This project also involves cracking down on grassroots resistance to accumulation, as demonstrated by the recent arrest of labor activists, labor-rights researchers, and Marxist intellectuals.

Along with online retailing and social media, real estate is one of the most important areas where private capital has been dominant. What might the panic at Evergrande mean for the transformation of this pivotal sector, which generates about 25 percent of China’s output and supports an asset bubble valued at four times the country’s GDP? It may be an opportunity for the Chinese party-state’s ongoing promotion of the state sector against its rivals. The Evergrande crisis was triggered by the state’s attempt to crack down on private property developers by restricting their access to state bank financing. It was hoped that this would force heavily indebted enterprises to deleverage. It has been reported that the Chinese government was pondering whether to break down and restructure Evergrande into a set of state-owned enterprises. The Evergrande crisis could turn out to be an opportunity for the party-state to nationalize one of the largest property developers in the economy, thereby reasserting the state’s substantive ownership of land property. This development is consistent with the state’s recent attack on giant private enterprises, with the possible endgame of making these companies state-owned or state-controlled. By breaking up companies like Evergrande, the state could separate the more profitable activities (such as the unit that manages existing housing) and wind down whatever is unsalvageable. If these assets were nationalized, they would be transferred to state-owned developers, which remain profit-oriented.

As in earlier moments of crisis, Beijing has made some gestures toward the need for a new growth model. Under the rubric of “common prosperity” and the call for wealth redistribution, Xi has tied Beijing’s private sector crackdown to the need to address inequality and even increase domestic consumption. Thus far, there is little evidence that this new round of redistribution is anything more than a redistribution of resources and power from the private sector to the less profitable but still profit-oriented state enterprises. Those who hope that Xi would bring socialism—a political-economic system in which people’s livelihoods are put before profit, investment, and growth—back to life are poised to be disappointed.

Courtesy Europe Solidaire Sans Frontières