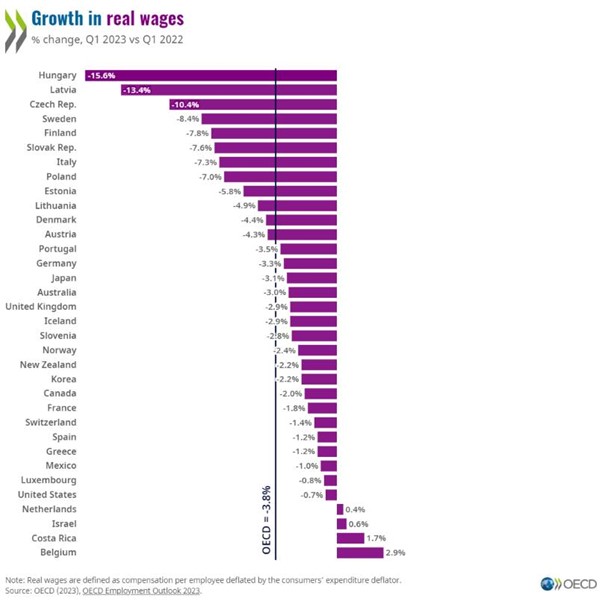

The latest employment report from the OECD is a real eye-opener on the cost of living crisis and whether wage rises or profit rises have been the biggest contributor to the rise in inflation. On wages, the OECD finds that real wages have fallen an average 3.8% in the last year in the OECD. “Labour markets have pushed up nominal wages, but less so than inflation, leading to a fall in real wages in almost all industries and OECD countries.”

The falls vary considerably for each OECD country. The biggest falls have been in Scandinavia and Eastern Europe, where energy prices rose the most from the loss of Russian oil and gas, while the US fall is one of the lowest as energy prices, although rising, have not shot up as much. Europe has had to switch from pipeline energy from Russia to much more expensive liquid natural gas (LNG) deliveries by shipping.

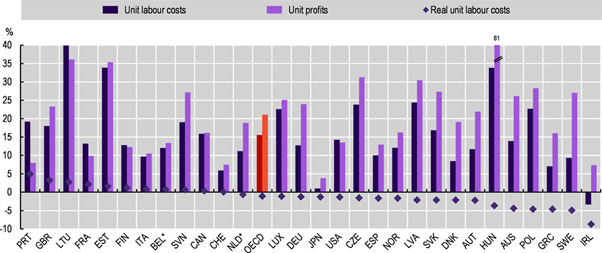

The OECD study also reveals in detail how much of the rise in inflation rates since the beginning of the COVID pandemic to now is due to wages and profits.

It seems that, on (unweighted) average throughout the OECD, profits per unit of output rose about 22% from end-2019 to Q1-2023, while wages per unit of output rose about 16%. In some countries, the role of profits in boosting prices was much greater compared to wages: Sweden 27% profits rise v 9% wages rise; Germany 24% v 10%; Austria 23% v 10%.

The largest rise in profits during the inflation spiral was in Hungary at over 60% followed by the Eastern European states at 30%-plus. Wage and profit increases per unit of output in the US were about equal at 14% each. Only Portugal saw a significantly higher contribution from wages per unit of output (18%) than profits (9%).

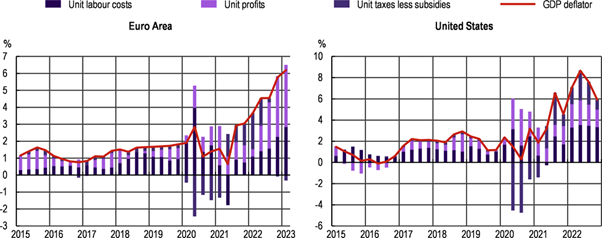

The OECD agrees with me and many others that the inflation spike was started by rising commodity and energy prices caused by supply chain blockages after the end of the pandemic and then accelerated by the Russian invasion of Ukraine.

As the OECD puts it: “The initial surge in inflation was largely imported in many OECD countries and driven by commodity and energy prices. However, over the course of 2022, inflation became more broad-based with higher costs increasingly being passed through into the prices of domestic goods and services.”

It was not caused by wage rises that never kept up with the inflation spiral. Again, the OECD says: “The evidence offers no indication of signs of a price-wage spiral so far. Nominal growth has picked up but it exhibits no clear signs of significant further acceleration across countries. The gap with inflation appears to be narrowing in recent months mostly because of a slow decline in inflation, but the erosion of real wages has not halted yet in the vast majority of OECD countries.”

Indeed, profit rises were a much larger factor in sustaining the inflation rise. The conclusions from the report are clear: first, average real wages (ie after inflation) have fallen across the developed capitalist world over the last three years – indeed the largest and longest fall for at least 50 years. And second, the main contributor to higher prices of goods and services over this period has been increases in profits per unit of output, not wages – particularly in the Eurozone. “In the Euro Area, the contribution of profits has been particularly large, accounting for most of the increase in domestic prices in the second half of 2022 and first quarter of 2023.” As for the US, the OECD reckons that: “amid particularly tight labour markets, wages have generally contributed to increases in domestic prices more than profits in recent quarters.” But “the recent contribution of profit margins was much larger than in the years before the crisis but has decreased in the most recent quarters.”

Data from Europe and Australia show that the strong performance of profits in 2022 was not limited to the energy sector. In the year to Q1 2023, in Europe, unit profits increased more than unit labour costs in manufacturing, construction and finance, and grew at the same rate as unit labour cost in “accommodation food and transportation”. Similarly, unit profits increased more than unit labour costs in several sectors in Australia, including “accommodation and food”, manufacturing, trade, and transportation.

So is this answer to reducing inflation rates, that firms should reduce profit increases? Well, maybe not, says the OECD because “firm profitability may be undermined in the short term by a fall in the demand due to the tightening of monetary policy and the erosion of purchasing power. In this context, rising labour costs might be more likely to translate into a reduction in labour demand and potential employment losses. All in all, while the evidence suggests room for profits to absorb some adjustments in wages in several sectors and countries, the exact room of manoeuvre will likely vary across sectors and type of firms.”

In other words, trying to reduce price rises by restricting profit rises while allowing workers wage rises to catch up could cause a slump as employers reduce their workforces to stop increased labour costs. That would mean rising unemployment. Yes, that is what happens under a profit-driven system of production.

So what is the answer to economic growth without inflation accelerating? The OECD says: “In the long run, sustained real wage gains can only be ensured through sustained productivity growth.” OECD countries need to “make the most of the opportunities afforded by new technological developments, such as Artificial Intelligence.” So far, no sign of that.

Courtesy Michael Roberts Blog

Michael Roberts

Michael Roberts worked in the City of London as an economist for over 40 years. He has closely observed the machinations of the global capitalism from within the dragon’s den. Since retiring, he has written several books. The Great Recession – a Marxist view (2009); The Long Depression (2016); Marx 200: a review of Marx’s economics (2018): and jointly with Guglielmo Carchedi as editors of World in Crisis (2018). He has published numerous papers in various academic economic journals and articles in leftist publications.