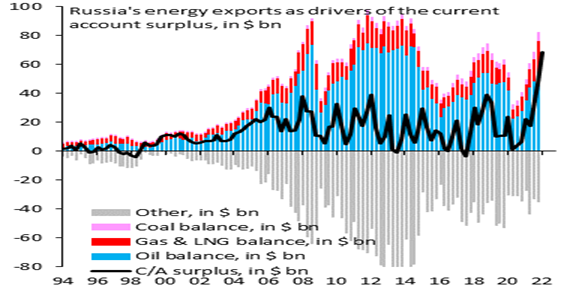

The G7 governments have a problem. The war in Ukraine against Russia is not won. It looks set to be a long grinding conflict, possibly with no end. And yet the world and particularly Europe depends on Russian energy supplies. The G7 has agreed to stop buying Russian oil, as part of its programme of using economics sanctions as a war weapon. But up to now, energy imports from Russia have not been stopped because it would mean a catastrophe for the EU countries, particularly Germany. And Russia is still selling huge volumes—globally – albeit at a discount from the world price—to India, China and other energy-thirsty economies.

At the beginning of June, the European Union agreed to bar its companies from “insuring and financing the transport, in particular, through maritime routes, of [Russian] oil to third parties” after the end of 2022 to make it “difficult for Russia to continue exporting its crude oil and petroleum products to the rest of the world.” But that is still not being implemented and Greek-owned tankers are delivering Russian oil exports across the globe and until this week, Russian gas was still being imported into Europe. As a result, the Russian trade surplus has rocketed as oil and gas export revenues rise, driven mainly by huge price increases.

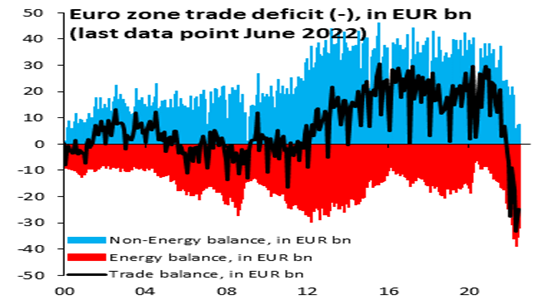

In a mirror image, the Eurozone trade balance has sunk into a severe deficit and the euro has slumped in value below the dollar for the first time in over 20 years.

In a mirror image, the Eurozone trade balance has sunk into a severe deficit and the euro has slumped in value below the dollar for the first time in over 20 years.

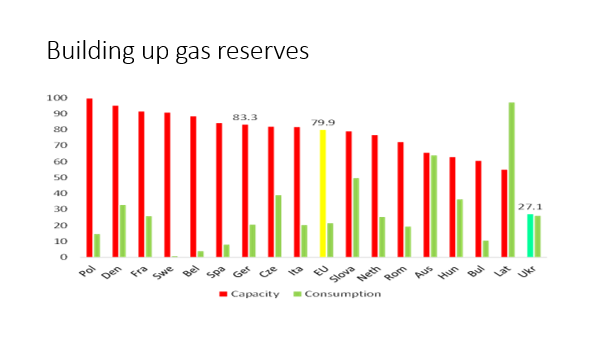

European governments have been desperately trying to find alternative sources of energy supply and have shopped around the world to buy gas and oil at going market prices. This has led to spiralling natural gas and oil prices. However, at great expense, Europe has been building up its gas storage to get through the coming winter. Gas storage levels are now at 80%of capacity and even higher in Germany.

European governments have been desperately trying to find alternative sources of energy supply and have shopped around the world to buy gas and oil at going market prices. This has led to spiralling natural gas and oil prices. However, at great expense, Europe has been building up its gas storage to get through the coming winter. Gas storage levels are now at 80%of capacity and even higher in Germany.

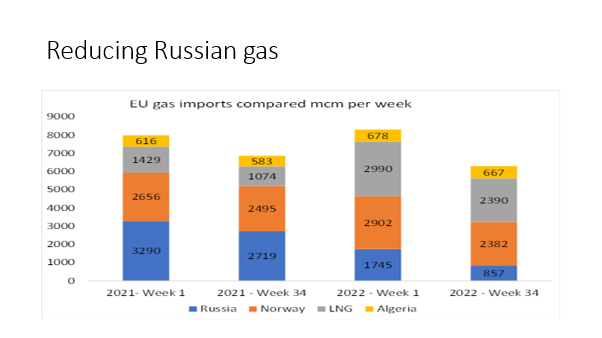

This has been done by switching to expensive liquid natural gas (LNG) imports brought in by ships. Europe has reduced its gas imports from Russia (partly by policy but mainly because Russia has cut gas supplies down to 20% in the key pipeline – and now this week to zero). To replace that loss, it has bought LNG from Spain and North America.

This has been done by switching to expensive liquid natural gas (LNG) imports brought in by ships. Europe has reduced its gas imports from Russia (partly by policy but mainly because Russia has cut gas supplies down to 20% in the key pipeline – and now this week to zero). To replace that loss, it has bought LNG from Spain and North America.

Even so, it will have to use up all its storage capacity to get through the winter without electricity cuts. And then what?

That’s why the G7 leaders have decided on a new sanction against Russia which they hope will speed up Russian capitulation on the war in Ukraine. Led by Janet Yellen, the US Treasury Secretary, they propose to introduce a price cap on all oil imports from Russia. Instead of applying a blanket ban on insuring or financing any Russian oil shipments, credit and insurance will be made available, as long as the price paid for Russian energy is below a certain level.

What level is still to be decided for the new year 2023. Currently the Brent crude oil price is about $90-100/barrel. So if the price cap were fixed at, say, $50/b, then Russian export revenues would presumably plummet and so Putin would lose funding for his war, while energy prices would drop sharply. Indeed, on this news gas and oil prices have dropped back, although they are still four times higher (gas) and 80% higher (oil) than before the war started.

Will this price cap weapon work? There are many holes in it. Russia could refuse to export oil at the lower price, though that would not only reduce one of its few sources of external revenue, it also would require shutting down oil wells that aren’t easily restarted. An extended shutdown of Russian oil wells could do severe and lasting damage to its production capacity. But Russia could continue to export oil to countries that refuse to abide by the G7 price cap, eg China and India. Indeed, before the invasion, India imported almost no Russian oil. By July it was importing close to 1mn b/d of Russian crude (heavily discounted), or about 1 percent of global supply. And then all countries must agree to use G7 insurance facilities and not resort to those outside their restrictions. Many countries may not follow the G7 strictures.

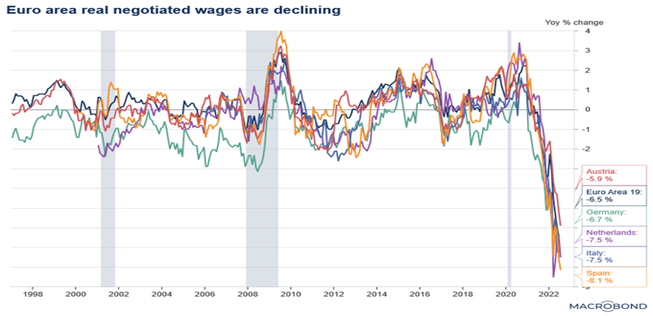

Meanwhile, the huge rises in global energy (and food) prices are creating a cost of living catastrophe. Everywhere in Europe, real wages are crashing.

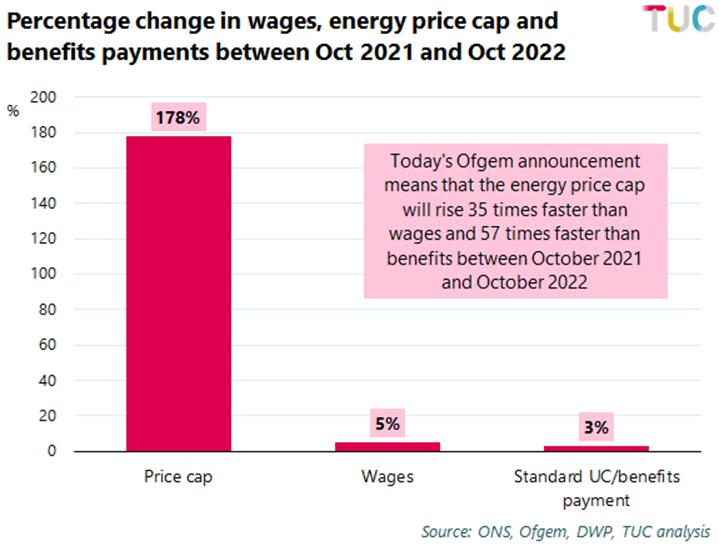

It’s worst of all in Britain. The Bank of England (BoE) forecasts the inflation rate to peak at 13.3% in October and real household disposable income is set to fall by 3.7% across 2022 and 2023, making those two years the worst on record. But it may be even worse than that. Citibank forecasts inflation is on course to rise to 18.6 per cent in January, the highest peak in almost half a century, due to soaring wholesale gas prices. And Goldman Sachs goes further as it expects even larger gas rises, and now expects UK inflation to peak at 22%!

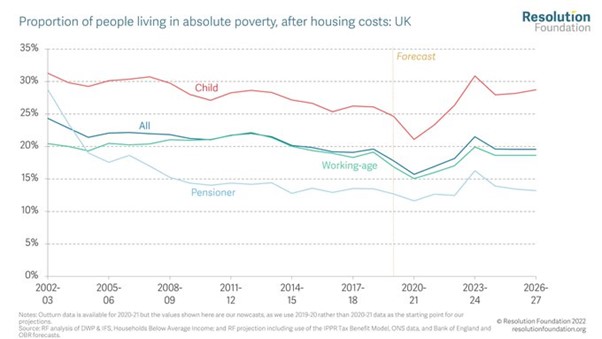

As always, it’s the poor that take the hardest hit. Over 40% of UK households will not be able to heat their homes properly in January when energy bills rise yet again. Yes, this is Britain in 2022. About 28mn people in 12mn homes, or 42 per cent of all households, will not be able to afford to adequately heat and power their properties from January, when a typical yearly energy bill is forecast to exceed £5,300. Even by October, when Britain’s energy price cap will rise 80 per cent to £3,549 9m households will face fuel poverty. With the current cost-of-living crisis being felt hardest by low-income households, absolute poverty is on track to rise by three million over the next two years), while relative child poverty is projected to reach its highest level (33% in 2026-27) since the peaks of the 1990s

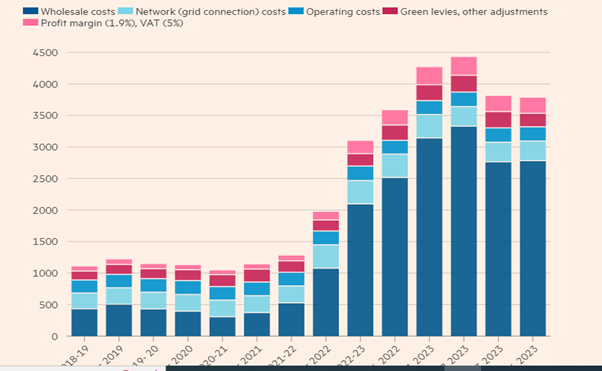

But what is this energy price cap that is applied in the UK? Supposedly it is to stop energy companies hiking their bills too much and making super-profits at the expense of households. In the UK, a regulator called Ofgem sets a price cap every six months that supposedly regulates the profitability of the privatized energy retail companies that charge customers for gas and electricity.

But this price cap has rocketed from under £1000 a year in 2021 to £3549 in October and then is forecast to reach an eye-watering £6600 by summer next year. These sorts of rises are completely impossible for average households and small companies to absorb, let alone the poorest and those with uninsulated homes.

How can these price rises be explained? Much is made of the profits being made by the retail energy monopolies and it is true that they are making big profits and distributing millions to their shareholders. But when you look at the breakdown of the costs for these retailers it tells a deeper story.

How can these price rises be explained? Much is made of the profits being made by the retail energy monopolies and it is true that they are making big profits and distributing millions to their shareholders. But when you look at the breakdown of the costs for these retailers it tells a deeper story.

What you find is that the energy retail companies are restricted by Ofgem to just a 2% profit rate on (total, not operating) costs. But those costs include the costs of getting the gas and electricity distributed down the pipes and lines to households. The suppliers of these services are a separate bunch of monopolies (in the UK, the Big Six). The Big Six can charge up to a 40% profit rate in their prices to the retail companies and so take up about 7-10% of the price to the householder. The distribution companies are owned by various hedge funds and private equity companies who take their cut.

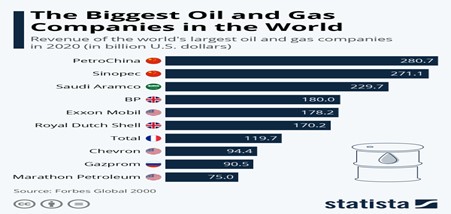

But the biggest part of the household bill is the price charged by the global energy companies for their gas and oil ie the likes of Shell, BP, Mobil, Exxon etc.

This is where the real profits bonanza is. The profits bonanza in the second quarter included a record $11.5bn profit for BP’s rival Shell, record profits of $17.6bn and $11.6bn respectively for the US’s ExxonMobil and Chevron, plus $9.8bn for France’s Total. In the first six months of the year the companies made combined adjusted profits of nearly $100bn.

So when the head of the UK’s Ofgem, Jonathan Brearley says that “We can’t force companies to buy energy for less than the price… we all need to work together”, in a way, he is right. If the market rules, then his regulatory powers can do little because he works on the principle that companies must make a profit. But if the goal of Ofgem is to ensure a fair deal for households in conditions of natural monopoly, then it has clearly failed in this mandate. The privatisation of gas and electricity distribution in the UK since the late 1980s and early 1990s has resulted in a handful of very large and very powerful firms enjoying large profit margins with shareholders reaping big dividends, while UK households are subjected to sky-high energy bills.

For example, the big six distributors have paid out almost £23 billion in dividends, six times their tax bill in the last ten years. But then as one CEO said, “Businesses are there to make a profit, and dividends are one way of sharing that with shareholders”.

The powers-that-be are also shocked by the energy price explosion. Indeed, several have put into question the economic principle of market pricing, calling it “frankly ludicrous” (Boris Johnson), 1 “absurd” (Emmanuel Macron), 2 and concluding that “this market system does not work anymore” (Ursula von der Leyen). The EU chief admitted that this was“exposing the limitations of our current electricity market design”. But what’s the answer? Well, “we need a new market model for electricity that really functions” (!). “Alternative market designs that could potentially include the decoupling of gas from the formation of the market price”. So gas prices would be controlled and not subject to the market – but how?

I won’t go further into the myriad of proposals coming from the UK government, the opposition Labour party and various think-tanks about how to relieve or avoid the catastrophe ahead for millions of households in Europe and particularly the UK. I won’t because there is one thing that they all have in common – there are no proposals to end the market for energy prices or to bring into common ownership the energy companies, retail, distribution and wholesale (the UK TUC proposes nationalization of retail only). To do so would require a revolutionary transformation of the structure of economies starting with energy.

And yet even on a limited scale, public ownership of energy works. In Germany, for instance, two-thirds of all electricity is purchased from municipally owned energy companies and, since 2016, the Munich city council has supplied enough renewable energy for the needs of every household. Denmark has a fully publicly owned transmission grid, and the highest proportion of wind power in the world. A publicly owned energy system can be complemented by smaller-scale developments, like community-owned energy. In 2008, the isle of Eigg was the first community to launch an off-grid electric system powered by wind, water and solar, allowing local people to have a greater stake and say in their energy.

But these steps are limited and partial. Overall, the market rules and Big Oil runs the show. And now market pricing is being aggravated by the desperate attempts of the G7 leaders to defeat Russia in the war.

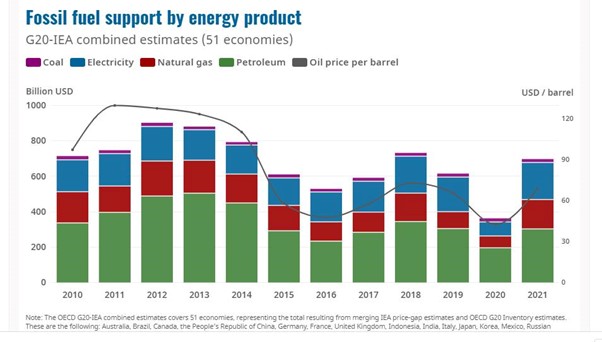

As a result, efforts to control carbon emissions and meet global targets are being reversed as fossil fuel energy production is accelerated and fossil fuel subsidies to help control energy prices are increased. Energy tax subsidies not only enforce the EU’s reliance on fossil fuel imports but also work against achieving the climate targets of the European Green Deal.

In the US, coal-fired power generation was higher in 2021 under President Joe Biden than it was in 2019 under then President Donald Trump, who had positioned himself as the would-be saviour of America’s coal industry. In Europe, coal power rose 18 per cent in 2021, its first increase in almost a decade.

Economist Dieter Helm, professor of energy policy at Oxford university, says the shift away from fossil fuels has rarely looked more complicated. “The energy transition was already in trouble — 80 per cent of the world’s energy is still from fossil fuels,” he said. “I expect that in the short term, the US will increase oil and gas output and EU coal consumption could increase”.

There is no escaping from the obvious conclusion. To avoid the energy catastrophe and reverse the huge loss in living standards already under way, we need to take over the fossil fuel companies and phase out their production with increased investment in renewables, to reduce fuel prices for households and small businesses.

But that means a global plan to steer investments into things society does need, like renewable energy, organic farming, public transportation, public water systems, ecological remediation, public health, quality schools and other currently unmet needs. Such a plan could also equalize development the world over by shifting resources out of useless and harmful production in the North and into developing the South, building basic infrastructure, sanitation systems, public schools, health care. At the same time, a global plan could aim to provide equivalent jobs for workers displaced by the retrenchment or closure of unnecessary or harmful industries.

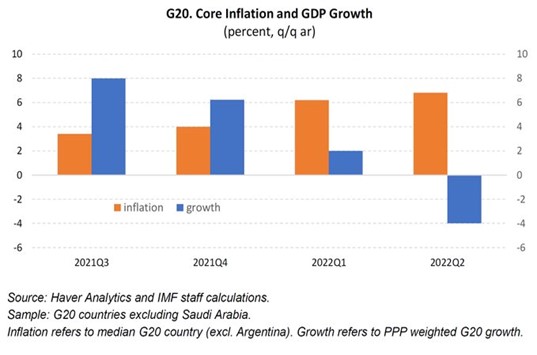

Fat chance of that now. Instead, millions face a cost of living crisis of record proportions. And don’t forget the prospect of a new global slump in production, investment and employment. According to the IMF, real GDP in the G20 countries (or more exactly 18 top economies exc Saudi Arabia) fell in Q2 2022. But the inflation rate continued to rise.

And the IMF notes, “The global outlook has already darkened significantly since April. The world may soon be teetering on the edge of a global recession, only two years after the last one.” Jacon Frenkel, head of the Group of 30 consortium of global policy makers, summed it up: “We have the energy crisis, we have the food crisis, we have the supply chain crisis and we have the war, all of which has profound implications for the economic performance of the world’.

Courtesy Michael Roberts Blog

Michael Roberts

Michael Roberts worked in the City of London as an economist for over 40 years. He has closely observed the machinations of the global capitalism from within the dragon’s den. Since retiring, he has written several books. The Great Recession – a Marxist view (2009); The Long Depression (2016); Marx 200: a review of Marx’s economics (2018): and jointly with Guglielmo Carchedi as editors of World in Crisis (2018). He has published numerous papers in various academic economic journals and articles in leftist publications.